Deduction from salary agreement template

If you need to make a regular deduction from the salary of an employee, issue this model agreement to obtain their consent.

- Includes 12 months' access to the Deduction from salary agreement template, with all updates provided free of charge and notified to you.

- UK-specific accuracy.

- 198 words over 1 page.

- Last updated 07/03/2023.

- Format: Word / plain text / email.

- Delivery: Instant download after purchase (no physical item).

- Access: Download link shown here after checkout.

- This Deduction from salary agreement template will SAVE you up to 30 mins drafting & research, save you money, and reduce your risk.

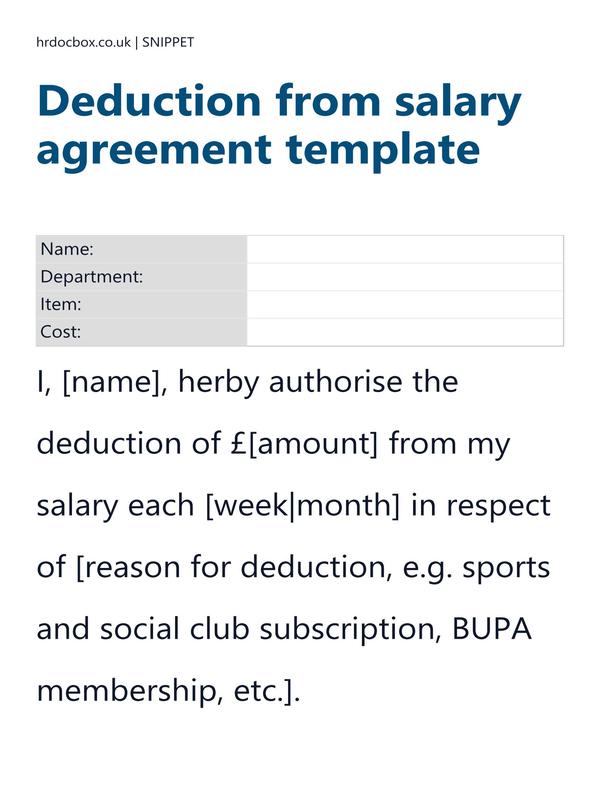

| Name: | |

| Department: | |

| Item: | |

| Cost: |

I, [name], herby authorise the deduction of £[amount] from my salary each [week|month] in respect of [reason for deduction, e.g. sports and social club subscription, BUPA membership, etc.].

This letter does

This is a 30% preview of the Deduction from salary agreement template. For instant full access, purchase this item or a parent bundle.

Deduction from salary agreement template purpose

A Deduction from Salary Agreement is a written agreement between an employer and employee that specifies the types of deductions that may be taken from an employee's salary. Deductions may be made for various reasons, such as taxes, insurance premiums, retirement contributions, or other benefits provided by the employer.

The agreement typically outlines the terms and conditions of the deductions, including the amount to be deducted, the frequency of deductions, and the duration of the agreement. It may also specify the circumstances under which deductions may be increased or decreased, and the process for disputing or challenging any deductions made.

Practical application of a Deduction from salary agreement template

- The Deduction from salary agreement template should be actioned / delivered as and when required.

- It is sent / delivered by an employer / HR team to an employee.

Compliance

Compliance

This Deduction from salary agreement template incorporates relevant UK laws and HR standards, including those listed below:

It is important to note that deductions from salary must comply with local labor laws and regulations, and the agreement must be signed by both the employer and employee before any deductions are made.

Section 13 of the Employment Rights Act 1996 makes it unlawful for an employer to make deductions from an employee's wages unless the employee has given prior written consent, or a relevant provision exists to this effect in the employment contract.

Deduction from salary agreement workflow

Deduction from salary agreement workflow

Check which resources should be implemeted before and/or after the Deduction from salary agreement template, to understand the workflow.

Pay or salary payment arrangements policy

Our pay or salary payment arrangements policy template provides information regarding pay or salary payment arrangements.

Frequently Asked Questions about a Deduction from salary agreement template

Frequently Asked Questions about a Deduction from salary agreement template

-

Can I use the Deduction from salary agreement template in my small business?

Yes. The Deduction from salary agreement template is designed to be flexible and suitable for organisations of all sizes, including small businesses and charities. It follows UK employment law best practice, so even if you don't have an in-house HR team, you can confidently apply it.

-

Is the Deduction from salary agreement template compliant with 2026 UK employment law?

Absolutely. Like the Deduction from salary agreement template, all of our templates are drafted with the latest ACAS guidance and UK employment legislation in mind. We review and update them regularly, so you can be confident they remain compliant.

-

Can I customise the Deduction from salary agreement template for my organisation?

Yes, we highlight the areas of the Deduction from salary agreement template that you need to update with your own details, and where you need to make decisions to suit your situation. This saves you time and ensures that you meet best practice.

-

Do I get instant access to the Deduction from salary agreement template?

Yes. Once purchased, you'll be able to download the Deduction from salary agreement template instantly. Templates are provided in editable Word or Excel format so you can customise them easily, and in PDF format for easy sharing.

-

What if I need more help, not just a Deduction from salary agreement template?

If you're looking for broader support, we also offer toolkits and library bundles that include the Deduction from salary agreement template, along with other HR templates and policies for fully managing your situation. These may be more cost-effective if you need deeper advice.

-

Why should I use this Deduction from salary agreement template, and not AI to generate it?

The risk of using a free AI-generated template 'without review' includes your legal exposure, missing context, and no awareness of the wider process, whereas purchasing the Deduction from salary agreement template from us mitigates that risk.