Pay and benefits templates toolkit

Pay and benefits templates to support compliant reward structures, pay reviews and employee benefits across your organisation.

Our templates are designed to address the specific aspects of pay and benefits management, from salary review letters to benefits enrolment forms. Whether you're adjusting compensation packages, communicating pay changes, or outlining benefits policies, our toolkit ensures you have the right documents to support your business and foster positive employee relations.

- Includes 12 months' access to 34 Pay And Benefits templates, with all updates to the Pay and benefits templates toolkit provided free of charge and notified to you.

- UK-specific accuracy.

- Instantly download templates as Word / PDF / plain text, or send by email.

- These Pay and benefits templates toolkit will SAVE you up to 21 hours drafting & research, save you money, and reduce your risk.

Pay and benefits

Pay and benefits are an important part of an employer's legal obligations to provide a fair and supportive working environment for their employees. Employers should ensure that they comply with relevant legislation and best practices, and that they provide their employees with fair and transparent pay and benefits packages.

Pay and benefit templates are useful to manage a wide range of issues, including:

-

National minimum wage and the national living wage.

-

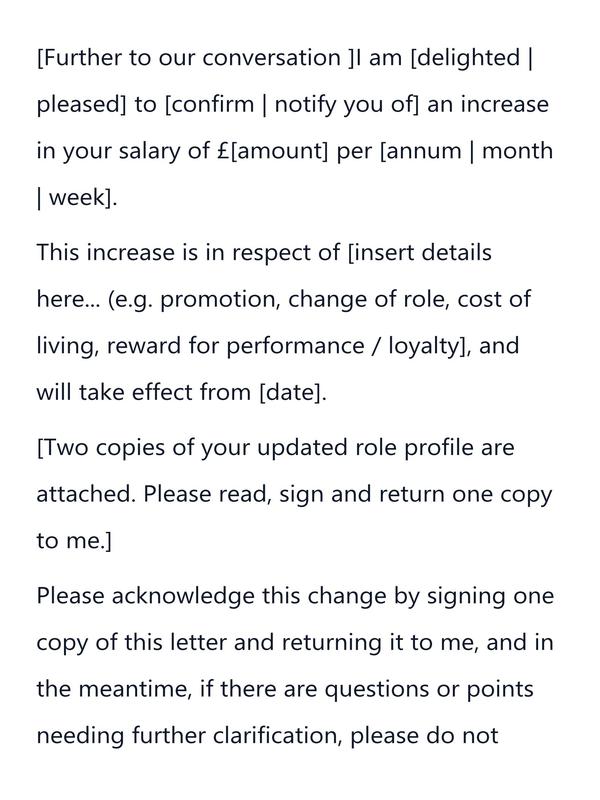

Pay increases after promotions, pay reviews, or job changes.

-

Bonuses.

-

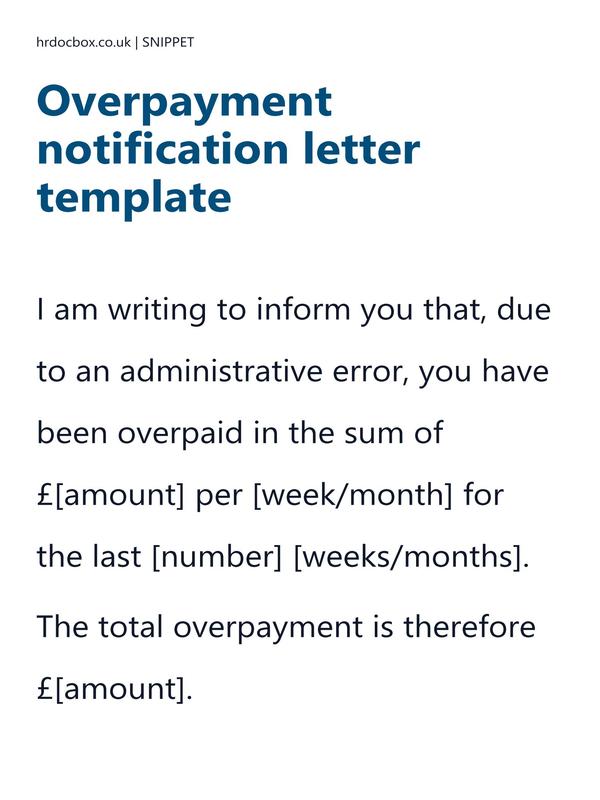

Overpayments.

-

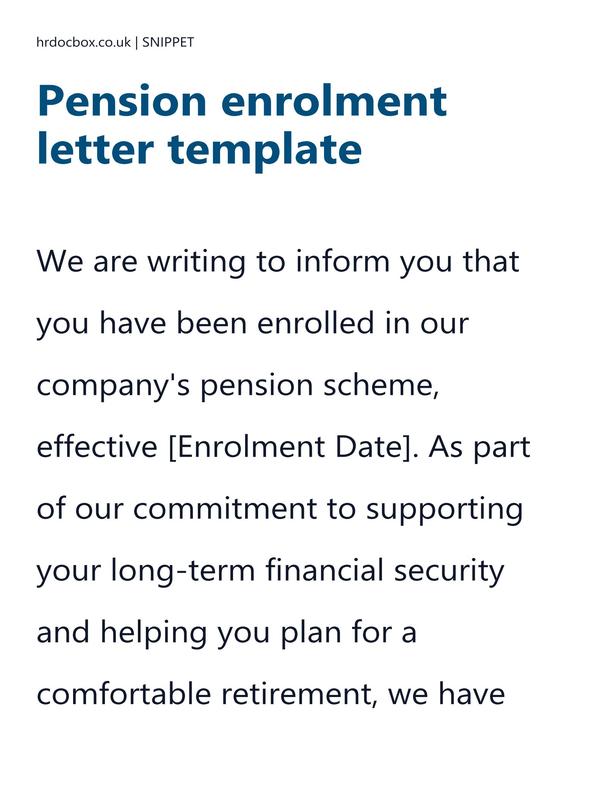

Pension administration and changes.

-

Benefits and benefit changes.

-

Loan repayments.

Pay and benefits HR templates help employers to manage their employees' salaries and benefits in a consistent and efficient manner. These templates can help to ensure compliance with relevant legislation and best practices, as well as to improve transparency and communication with employees.

Using pay and benefits HR templates can help employers to save time and effort in managing their employees' salaries and benefits, as well as to ensure consistency and compliance with relevant legislation and best practices. However, it is important to ensure that templates are customised to meet the specific needs of the business and the employees, and that they are reviewed regularly to ensure that they remain up-to-date and effective.

Pay and benefits templates are essential for managing a low-risk, compliant Pay and benefits process.

Compliance

Compliance

-

The UK has a national minimum wage, which sets out the minimum hourly rate that employers must pay their employees. The rate varies depending on the employee's age and whether they are an apprentice.

-

Employers must provide employees with a payslip that sets out their pay and deductions, including tax and National Insurance contributions.

-

Employees have a legal right to receive equal pay for equal work. This means that employers must ensure that employees are paid the same rate for the same or similar work, regardless of their gender, race, age, or other protected characteristics.

-

Employers can provide their employees with a range of different benefits, such as pensions, private medical insurance, and flexible working arrangements. These benefits can be used to attract and retain staff, as well as to improve employee wellbeing and job satisfaction.

-

Employers have a legal obligation to provide their employees with a workplace pension scheme, and to contribute to that scheme on behalf of their employees.

-

Employers must comply with relevant legislation when calculating and paying employee salaries and benefits, including the Income Tax (Earnings and Pensions) Act 2003, the Equality Act 2010, and the Pensions Act 2008.

-

Failure to comply with pay and benefits legislation can lead to legal claims from employees, including claims for breach of contract, discrimination, and unlawful deduction of wages.

Key Pay And Benefits Case Law

Key Pay And Benefits Case Law

Navigating Pay and benefits processes correctly is crucial to help you avoid any problems (which can be costly in terms of time, money and reputation).

Recent UK case law has highlighted key aspects of good Pay and benefits management. Knowing how courts have handled claims can help you assess whether your proposed actions are likely to be seen as reasonable.

Here are some notable rulings and their implications:

-

Asda Stores Ltd v Brierley and others (2021): This landmark case dealt with equal pay claims by predominantly female retail employees against predominantly male distribution employees. The Supreme Court ruled that the two groups could compare their roles for the purposes of equal pay claims, allowing the case to proceed to the next stage of deciding if the work is of equal value.

-

Samira Ahmed v BBC (2020): In this case, journalist Samira Ahmed claimed that she was underpaid compared to her male colleague, Jeremy Vine, for similar work. The Employment Tribunal ruled in her favour, concluding that the BBC had not justified the pay difference, highlighting the ongoing issues of gender pay disparities in high-profile organisations.

-

Pimlico Plumbers Ltd and another v Smith (2018): Although slightly older, this case remains influential. The Supreme Court ruled that a plumber who had worked solely for Pimlico Plumbers was entitled to workers' rights, including holiday pay, even though he was technically self-employed. This case has had significant implications for the gig economy and the classification of workers.

-

Antuzis v DJ Houghton Catching Services Ltd (2019): This case involved Lithuanian chicken catchers who successfully claimed that their employer had unlawfully deducted wages and failed to pay the minimum wage. The High Court ruled in favour of the workers, reinforcing protections against wage theft and ensuring compliance with minimum wage laws.

-

Uber BV v Aslam and others (2021): In a highly publicised case, the Supreme Court ruled that Uber drivers are workers, not independent contractors, entitling them to benefits such as the National Minimum Wage and holiday pay. This ruling has had broad implications for the gig economy, affecting how companies classify and compensate their workers.

Instantly unlock with a purchase.

Instantly unlock with a purchase.

Frequently Asked Questions about Pay And Benefits templates

Frequently Asked Questions about Pay And Benefits templates

-

Can small businesses use these Pay and benefits templates?

Yes. The Pay and benefits templates in this toolkit are designed to be flexible and suitable for organisations of all sizes, including small businesses and charities. They follow UK employment law best practice, so even if you don't have an in-house HR team, you can confidently manage Pay and benefits processes and issues.

-

Are these Pay and benefits templates up to date for UK law in 2026?

Absolutely. All templates are drafted with the latest ACAS guidance and UK employment legislation in mind. We review and update them regularly, so you can be confident they remain compliant.

-

What types of Pay and benefits letters and documents are included?

Every toolkit includes a complete set of editable templates, supporting documents, and manager guidance designed to save time and ensure compliance.

-

How will this help me as an HR manager or business owner?

Purchasing the toolkit saves you hours of drafting time and reduces the risk of legal mistakes. Instead of starting from scratch, you'll have clear, professional templates that you can adapt to your business.

-

Do I get instant access to the templates?

Yes. Once purchased, you'll be able to download the Pay and benefits toolkit instantly. The templates are provided in editable Word or Excel format so you can customise them easily, and PDF format for easy sharing.

-

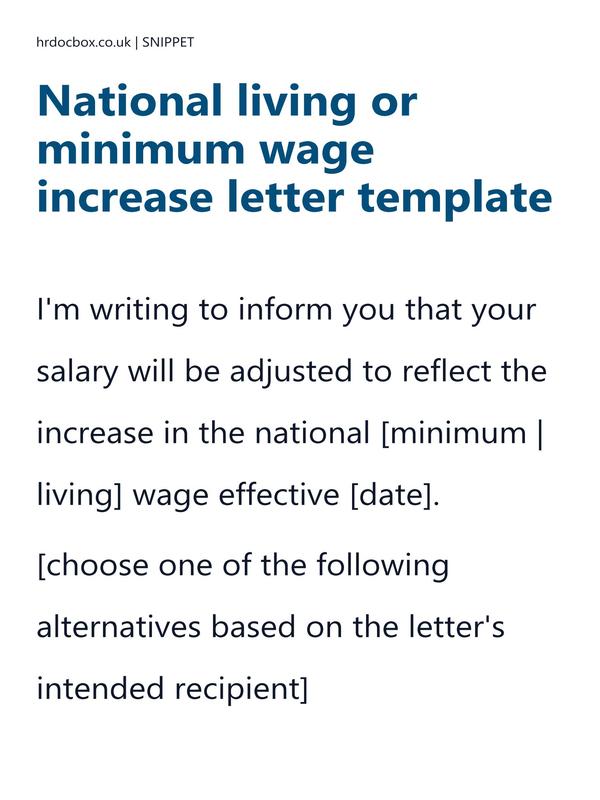

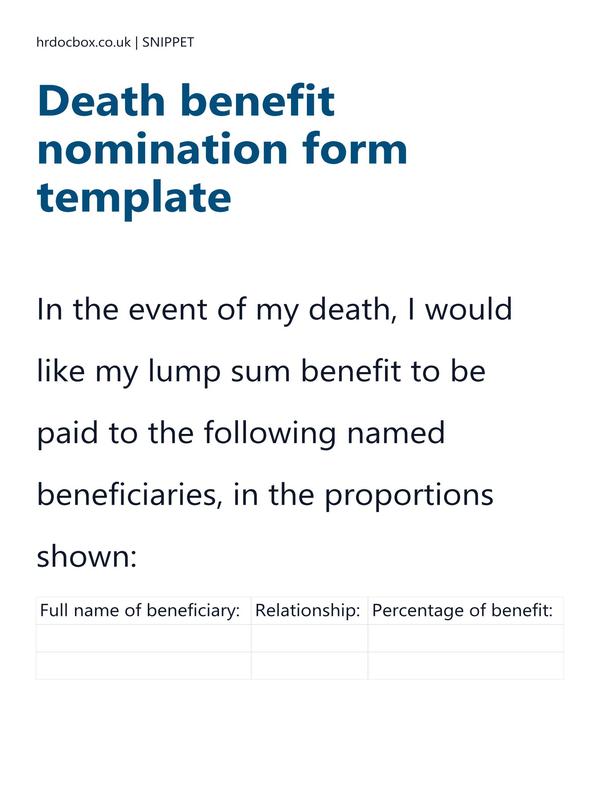

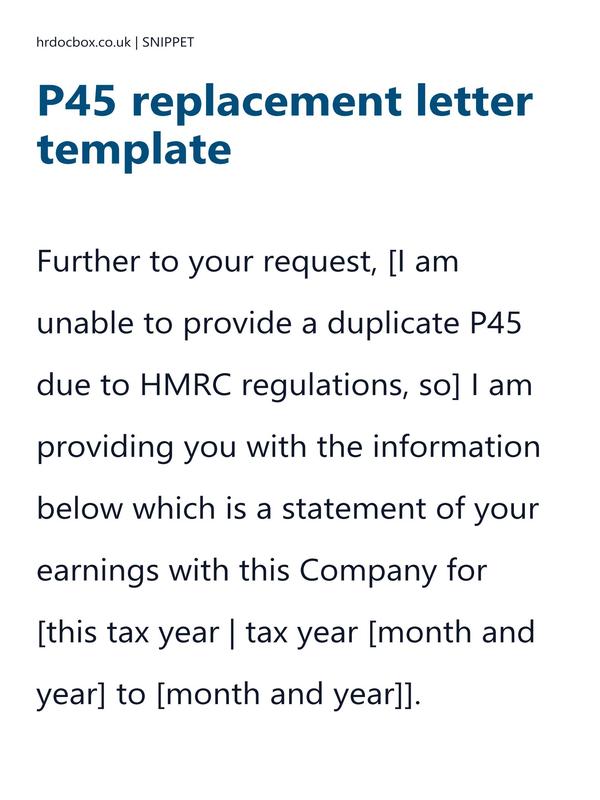

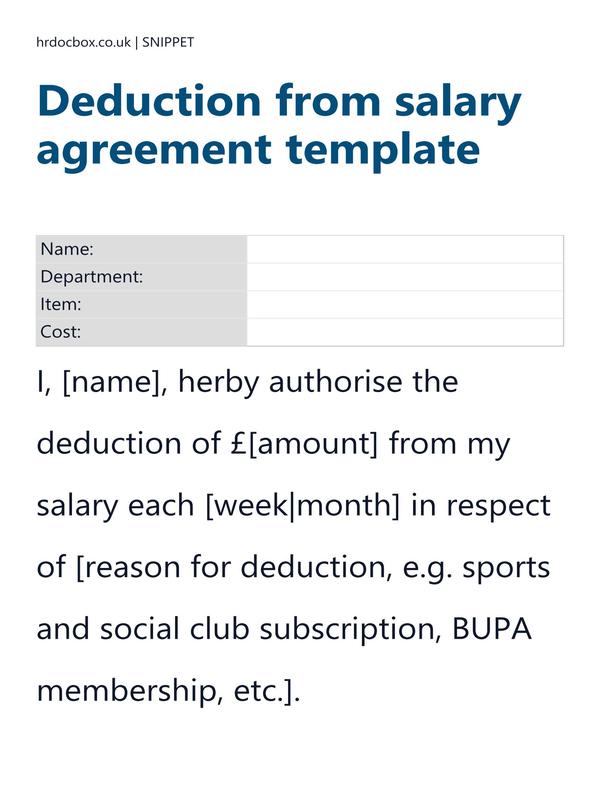

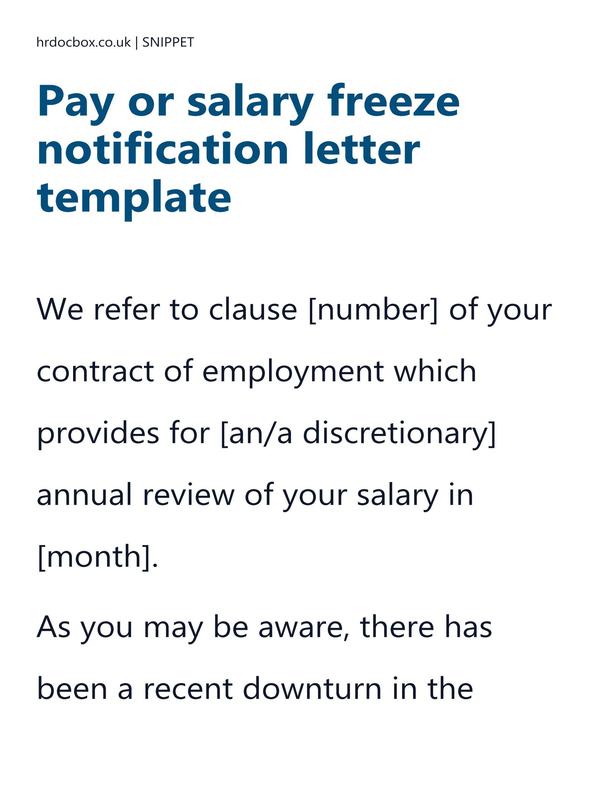

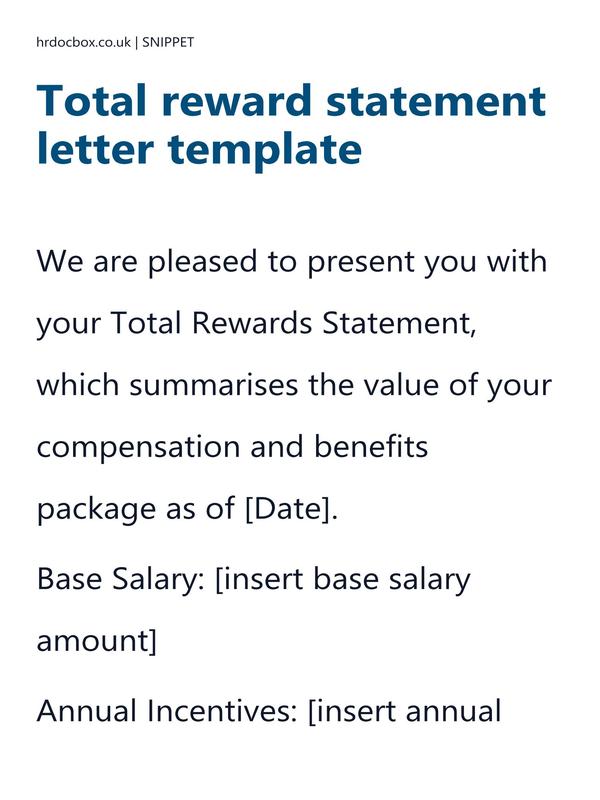

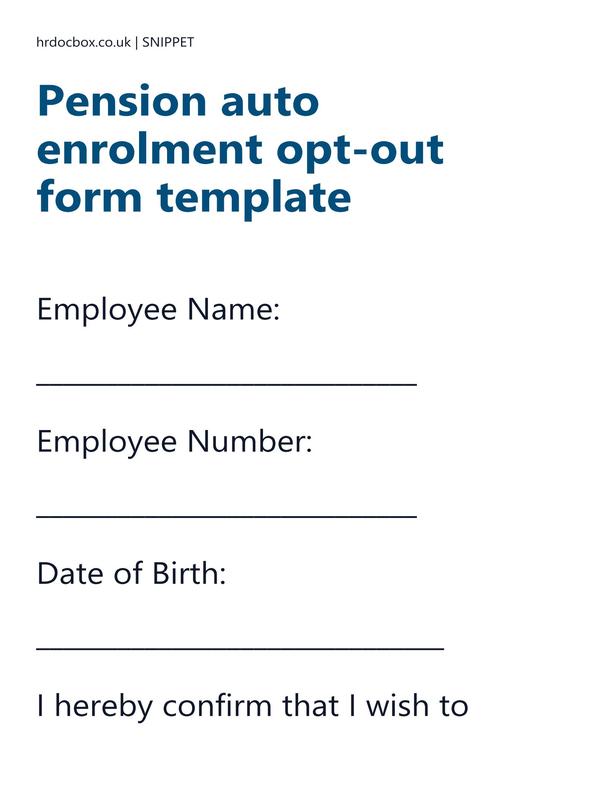

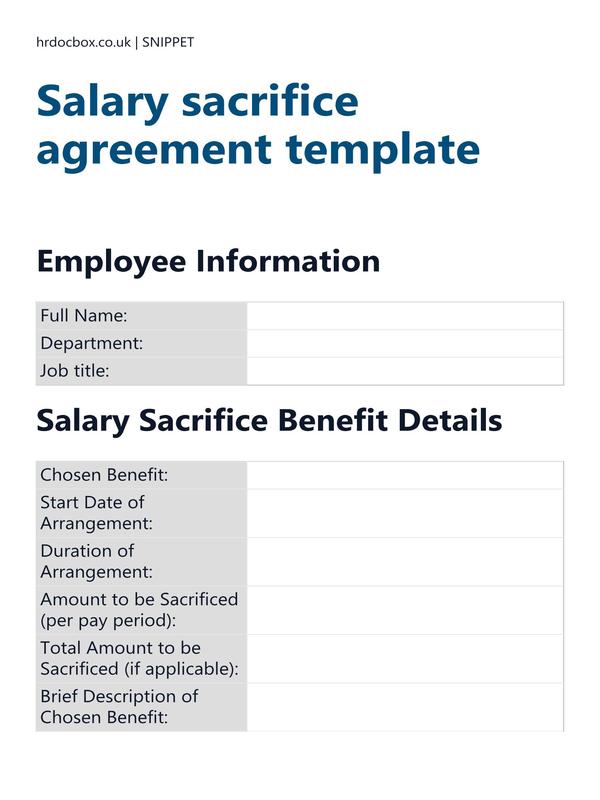

Can I preview a sample Pay and benefits template before buying?

We provide free examples of our templates here. This gives you a sense of the quality and layout before you commit to purchasing the full toolkit.

-

What if I need a full HR toolkit, not just Pay and benefits templates?

If you're looking for broader support, we also offer library bundles that include Pay and benefits templates along with absence, grievance, and other HR policies. These may be more cost-effective if you need a complete HR library.

-

Why should I use these templates, and not AI to generate them?

The risk of using free AI-generated templates 'without review' includes your legal exposure, missing context, and no awareness of the wider process. Purchasing from us mitigates that risk.

-preview.jpg)

-template-preview.jpg)

-entitlement-confirmation-letter-template-preview.jpg)