Salary sacrifice termination or changes form template

Our Salary Sacrifice Termination or Changes Form allows employees to request adjustments or cessation of their salary sacrifice arrangement, ensuring clear communication and proper record-keeping.

- Includes 12 months' access to the Salary sacrifice termination or changes form template, with all updates provided free of charge and notified to you.

- UK-specific accuracy.

- 232 words over 1 page.

- Last updated 16/08/2023.

- Format: Word / XLS / plain text / email.

- Delivery: Instant download after purchase (no physical item).

- Access: Download link shown here after checkout.

- This Salary sacrifice termination or changes form template will SAVE you up to 1 hour drafting & research, save you money, and reduce your risk.

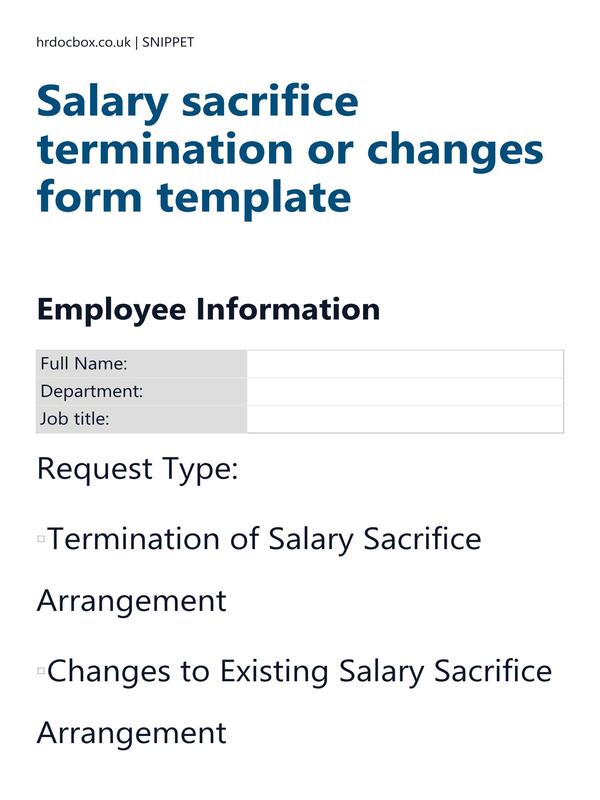

Salary sacrifice termination or changes

Employee Information

| Full Name: | |

| Department: | |

| Job title: |

Request Type:

Termination of Salary Sacrifice Arrangement

Changes to Existing Salary Sacrifice Arrangement

Existing Benefit Details

| Chosen Benefit: | |

| Start Date |

This is a 30% preview of the Salary sacrifice termination or changes form template. For instant full access, purchase this item or a parent bundle.

Salary sacrifice termination or changes form template purpose

This Salary Sacrifice Termination or Changes Form facilitates the process of recording and formalizing any changes or termination of a salary sacrifice arrangement.

It captures details about the employee, the specific benefit being modified, the effective date of the change, and the reason for the adjustment or termination.

The purpose of this form is to ensure accurate documentation, adherence to legal requirements, and clear communication between the employee and the employer regarding any alterations to the salary sacrifice arrangement.

Practical application of a Salary sacrifice termination or changes form template

- The Salary sacrifice termination or changes form template should be actioned / delivered as and when required.

- It is sent / delivered by an employee to an employer / HR team.

Compliance

Compliance

This Salary sacrifice termination or changes form template incorporates relevant UK laws and HR standards, including those listed below:

When implementing a Salary Sacrifice Termination or Changes Form, it's important to be aware of key UK employment legislations. Here are some of the essential ones:

-

Income Tax (Earnings and Pensions) Act 2003: This legislation provides the necessary framework for addressing tax implications when terminating or making changes to a salary sacrifice arrangement, ensuring that the process is aligned with tax regulations.

-

Employment Rights Act 1996: The form and its associated process must comply with the stipulations of this act, guaranteeing that employees' rights are respected, and their obligations are communicated transparently when salary sacrifice arrangements are altered or terminated.

-

Equality Act 2010: Changes or terminations communicated through the form should adhere to the principles of fairness and equality enshrined in this act, preventing any discriminatory practices and ensuring that all employees are treated equally in the process.

-

Pensions Act 2008: In the event that the salary sacrifice arrangement involves pension contributions, the form and its process should follow the guidelines outlined by this legislation, particularly regarding the treatment of pension benefits during changes or terminations.

-

Data Protection Act 2018 (incorporating GDPR): As personal data may be involved in the form, it's essential that the handling of such data during the termination or changes process aligns with the data protection principles set forth by this legislation, ensuring the security and confidentiality of employees' information.

Frequently Asked Questions about a Salary sacrifice termination or changes form template

Frequently Asked Questions about a Salary sacrifice termination or changes form template

-

Can I use the Salary sacrifice termination or changes form template in my small business?

Yes. The Salary sacrifice termination or changes form template is designed to be flexible and suitable for organisations of all sizes, including small businesses and charities. It follows UK employment law best practice, so even if you don't have an in-house HR team, you can confidently apply it.

-

Is the Salary sacrifice termination or changes form template compliant with 2026 UK employment law?

Absolutely. Like the Salary sacrifice termination or changes form template, all of our templates are drafted with the latest ACAS guidance and UK employment legislation in mind. We review and update them regularly, so you can be confident they remain compliant.

-

Can I customise the Salary sacrifice termination or changes form template for my organisation?

Yes, we highlight the areas of the Salary sacrifice termination or changes form template that you need to update with your own details, and where you need to make decisions to suit your situation. This saves you time and ensures that you meet best practice.

-

Do I get instant access to the Salary sacrifice termination or changes form template?

Yes. Once purchased, you'll be able to download the Salary sacrifice termination or changes form template instantly. Templates are provided in editable Word or Excel format so you can customise them easily, and in PDF format for easy sharing.

-

What if I need more help, not just a Salary sacrifice termination or changes form template?

If you're looking for broader support, we also offer toolkits and library bundles that include the Salary sacrifice termination or changes form template, along with other HR templates and policies for fully managing your situation. These may be more cost-effective if you need deeper advice.

-

Why should I use this Salary sacrifice termination or changes form template, and not AI to generate it?

The risk of using a free AI-generated template 'without review' includes your legal exposure, missing context, and no awareness of the wider process, whereas purchasing the Salary sacrifice termination or changes form template from us mitigates that risk.