Overpayment notification letter template

Our Overpayment Notification Letter Template addresses overpayment errors promptly, ensuring clear communication and resolution for all parties involved.

- Includes 12 months' access to the Overpayment notification letter template, with all updates provided free of charge and notified to you.

- UK-specific accuracy.

- 289 words over 2 pages.

- Last updated 30/01/2023.

- Format: Word / plain text / email.

- Delivery: Instant download after purchase (no physical item).

- Access: Download link shown here after checkout.

- This Overpayment notification letter template will SAVE you up to 1 hour drafting & research, save you money, and reduce your risk.

[Sender name]

[Sender address]

[date]

[Recipient name]

[Recipient address]

Dear [Recipient first name],

Overpayment of salary

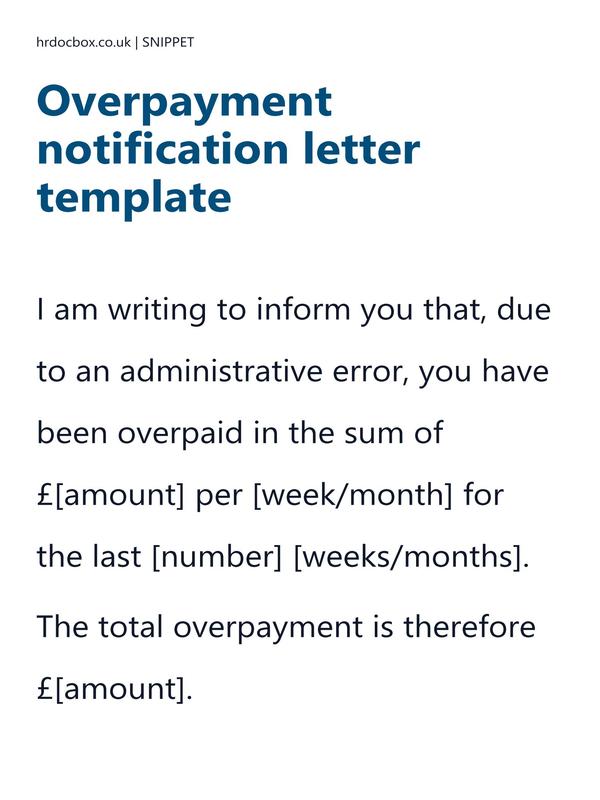

I am writing to inform you that, due to an administrative error, you have been overpaid in the sum of £[amount] per [week/month] for the last [number] [weeks/months].

The total overpayment is therefore £[amount].

In accordance with section 14(1) of the Employment Rights Act 1996, the Company now wishes to recover from you the sum that you have been overpaid by deducting the overpayment from your wages. However, at the same time, the Company does not wish to cause you any financial hardship. Consequently, we would

This is a 30% preview of the Overpayment notification letter template. For instant full access, purchase this item or a parent bundle.

Overpayment notification letter template purpose

A salary overpayment letter informs employees of excess payment and repayment terms. It may suggest repayment methods and highlight legal obligations. Prompt and fair handling of overpayments helps prevent legal or financial issues, promoting employee understanding and corrective action.

Practical application of a Overpayment notification letter template

- The Overpayment notification letter template should be actioned / delivered as soon as the overpayment has been identified.

- It is sent / delivered by an employer / HR team to an employee.

Compliance

Compliance

This Overpayment notification letter template incorporates relevant UK laws and HR standards, including those listed below:

As soon as an overpayment is identified, you should take action as possible. This would involve raising the issue with the employee to explain how you intend to recover the money, usually by deducting from the employee's future salary payments until the amount is paid off.

Here are some UK employment legislation considerations to keep in mind when implementing an overpayment notification letter:

-

Under the Employment Rights Act 1996, employers must ensure that any deductions made from an employee's pay are lawful and do not take the employee's pay below the national minimum wage.

-

Employers must follow the principles of natural justice and fairness when dealing with overpayments. This means giving the employee an opportunity to respond and challenge the overpayment before any deductions are made.

-

The letter should include clear and concise information about the amount of the overpayment, the reason for the overpayment, and how the employee can repay the amount.

-

Employers should be aware that some employees may have the right to set off the overpayment against any money owed to them by the employer. This should be taken into account when calculating any deductions.

-

If the overpayment is due to an error made by the employer, the employer should consider waiving the overpayment if it would cause financial hardship to the employee. However, if the overpayment is significant, the employer may need to recover the overpayment to avoid a loss to the business.

-

Employers must keep accurate records of any deductions made from an employee's pay and provide a payslip that clearly shows the amount of any deductions.

Overpayment notification workflow

Overpayment notification workflow

Check which resources should be implemeted before and/or after the Overpayment notification letter template, to understand the workflow.

Pay or salary payment arrangements policy

Our pay or salary payment arrangements policy template provides information regarding pay or salary payment arrangements.

Timings

Timings

Follow these best practice actions to get the most from the Overpayment notification letter template, guiding you before, during, and after implementation:

Instantly unlock with a purchase.

Instantly unlock with a purchase.

| Step | Description | Responsibility | Timing (Days from Overpayment) |

| 1 | Identify Overpayment: Identify the overpayment made to the employee through payroll records and financial analysis. | HR / Payroll Team | N/A |

| 2 | Verify Overpayment: Cross-check the overpayment with relevant data and verify the accuracy of the excess amount. | HR / Finance Team | Day 1 |

| 3 | Calculate Repayment Amount: Determine the exact amount of overpayment and calculate the repayment sum accurately. | HR / Finance Team | Day 2 |

| 4 | Prepare Overpayment Notification Letter: Create a comprehensive Overpayment Notification Letter, stating the reason for the overpayment, the amount to be repaid, and the repayment options. | HR / Management Team | Day 5 |

| 5 | Issue the Overpayment Notification Letter: Deliver the Overpayment Notification Letter to the employee, officially informing them of the overpayment and requesting repayment. | HR / Management Team | Day 7 (Or as deemed appropriate) |

Frequently Asked Questions about a Overpayment notification letter template

Frequently Asked Questions about a Overpayment notification letter template

-

Can I use the Overpayment notification letter template in my small business?

Yes. The Overpayment notification letter template is designed to be flexible and suitable for organisations of all sizes, including small businesses and charities. It follows UK employment law best practice, so even if you don't have an in-house HR team, you can confidently apply it.

-

Is the Overpayment notification letter template compliant with 2026 UK employment law?

Absolutely. Like the Overpayment notification letter template, all of our templates are drafted with the latest ACAS guidance and UK employment legislation in mind. We review and update them regularly, so you can be confident they remain compliant.

-

Can I customise the Overpayment notification letter template for my organisation?

Yes, we highlight the areas of the Overpayment notification letter template that you need to update with your own details, and where you need to make decisions to suit your situation. This saves you time and ensures that you meet best practice.

-

Do I get instant access to the Overpayment notification letter template?

Yes. Once purchased, you'll be able to download the Overpayment notification letter template instantly. Templates are provided in editable Word or Excel format so you can customise them easily, and in PDF format for easy sharing.

-

What if I need more help, not just a Overpayment notification letter template?

If you're looking for broader support, we also offer toolkits and library bundles that include the Overpayment notification letter template, along with other HR templates and policies for fully managing your situation. These may be more cost-effective if you need deeper advice.

-

Why should I use this Overpayment notification letter template, and not AI to generate it?

The risk of using a free AI-generated template 'without review' includes your legal exposure, missing context, and no awareness of the wider process, whereas purchasing the Overpayment notification letter template from us mitigates that risk.