P45 replacement letter template

Our P45 Replacement Letter Template ensures prompt resolution of P45 errors, minimising confusion and inconvenience for both employees and the company.

This model letter can be used as a standalone statement of earnings, or after a request from an employee of a copy of a lost P45.

- Includes 12 months' access to the P45 replacement letter template, with all updates provided free of charge and notified to you.

- UK-specific accuracy.

- 96 words over 1 page.

- Last updated 03/01/2026.

- Format: Word / plain text / email.

- Delivery: Instant download after purchase (no physical item).

- Access: Download link shown here after checkout.

- This P45 replacement letter template will SAVE you up to 30 mins drafting & research, save you money, and reduce your risk.

[Sender name]

[Sender address]

[date]

[Recipient name]

[Recipient address]

Dear [Recipient first name],

Statement of Earnings

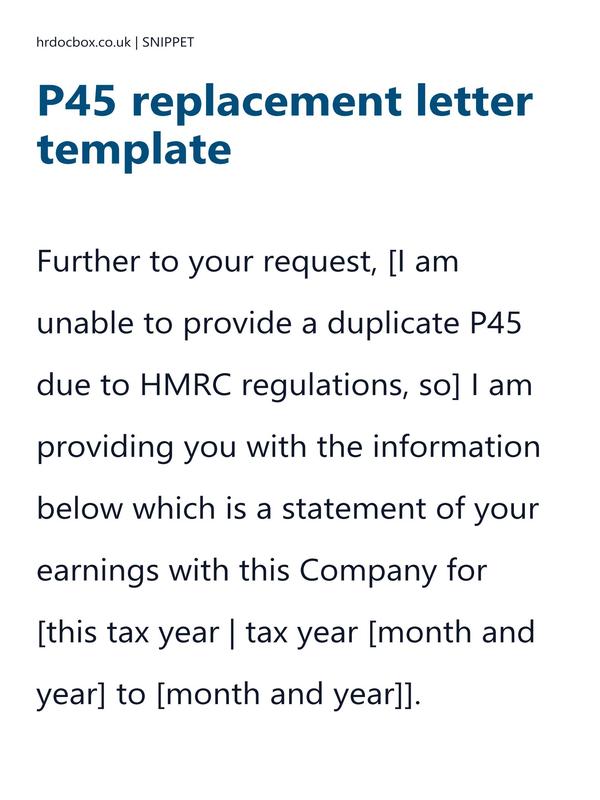

Further to your request, [I am unable to provide a duplicate P45 due to HMRC regulations, so] I am providing you with the information below which is

This is a 30% preview of the P45 replacement letter template. For instant full access, purchase this item or a parent bundle.

P45 replacement letter template purpose

P45's are not able to be replaced once issued due to HMRC regulations.

A P45 replacement letter is a letter issued by an employer to an employee who has lost their original P45 document or did not receive it when they left their employment. A P45 is a document issued by an employer when an employee leaves their job, which contains information about their earnings and tax deductions during their employment.

The P45 replacement letter serves as a replacement for the original P45 document and provides the employee with the necessary information about their earnings and tax deductions.

Practical application of a P45 replacement letter template

- The P45 replacement letter template should be actioned / delivered upon request from the ex-employee.

- It is sent / delivered by an employer / HR team to an employee.

Compliance

Compliance

This P45 replacement letter template incorporates relevant UK laws and HR standards, including those listed below:

It is important for employers to issue a P45 replacement letter promptly when an employee requests it or when the employer becomes aware that the employee did not receive their original P45. This is because the employee may need the P45 replacement letter to provide to their new employer or to claim any tax refunds that they are entitled to.

-

The Employment Rights Act 1996: This act sets out the rights and responsibilities of employees and employers, including the right of employees to receive a P45 when they leave employment. When issuing a P45 replacement letter, it is important to ensure that the employee's rights are respected and that they receive the correct documentation.

-

The Data Protection Act 2018: This act regulates the processing of personal data and provides individuals with certain rights over their personal data. When issuing a P45 replacement letter, it is important to ensure that any personal data is processed in accordance with the act and that the employee's rights are respected.

-

The National Minimum Wage Act 1998: This act sets out the minimum wage rates that must be paid to employees. When issuing a P45 replacement letter, it is important to ensure that any final payments made to the employee, such as outstanding wages or holiday pay, comply with the requirements of the act.

-

The Equality Act 2010: This act prohibits discrimination, harassment, and victimisation on the basis of various protected characteristics, such as age, race, gender, and disability. When issuing a P45 replacement letter, it is important to ensure that the letter does not contain any discriminatory language or actions.

Practical example

Practical example

Instantly unlock with a purchase.

Instantly unlock with a purchase.

Scenario

XYZ Limited, a UK-based company, is required to issue a replacement for a lost or missing P45 form for an employee who has recently left the company. HR Manager Sarah is responsible for drafting a replacement P45 letter to fulfil this requirement

Initial Response

Sarah receives the request for a replacement P45 letter from the former employee and verifies the details provided to ensure accuracy.

Drafting the Letter

Sarah carefully drafts a replacement P45 letter, ensuring it is professional, concise, and compliant with HMRC regulations. The letter should acknowledge the request for the replacement P45 and provide the necessary information typically found on the form.

Content of the Letter

The replacement P45 letter serves as a substitute for the official P45 form and includes all the relevant information required by HMRC. This includes the employee's personal details, tax code, details of employment termination, and earnings during the tax year.

Sending the Letter

Once the letter is finalised, Sarah sends it to the former employee via email or post, ensuring timely delivery. She may also provide guidance on how to use the replacement letter for tax purposes and advise the employee to keep it for their records.

Frequently Asked Questions about a P45 replacement letter template

Frequently Asked Questions about a P45 replacement letter template

-

Can I use the P45 replacement letter template in my small business?

Yes. The P45 replacement letter template is designed to be flexible and suitable for organisations of all sizes, including small businesses and charities. It follows UK employment law best practice, so even if you don't have an in-house HR team, you can confidently apply it.

-

Is the P45 replacement letter template compliant with 2026 UK employment law?

Absolutely. Like the P45 replacement letter template, all of our templates are drafted with the latest ACAS guidance and UK employment legislation in mind. We review and update them regularly, so you can be confident they remain compliant.

-

Can I customise the P45 replacement letter template for my organisation?

Yes, we highlight the areas of the P45 replacement letter template that you need to update with your own details, and where you need to make decisions to suit your situation. This saves you time and ensures that you meet best practice.

-

Do I get instant access to the P45 replacement letter template?

Yes. Once purchased, you'll be able to download the P45 replacement letter template instantly. Templates are provided in editable Word or Excel format so you can customise them easily, and in PDF format for easy sharing.

-

What if I need more help, not just a P45 replacement letter template?

If you're looking for broader support, we also offer toolkits and library bundles that include the P45 replacement letter template, along with other HR templates and policies for fully managing your situation. These may be more cost-effective if you need deeper advice.

-

Why should I use this P45 replacement letter template, and not AI to generate it?

The risk of using a free AI-generated template 'without review' includes your legal exposure, missing context, and no awareness of the wider process, whereas purchasing the P45 replacement letter template from us mitigates that risk.